Travel and Expense

The Blueprint of a Best Practice Expense Process

Nobody wakes up excited about managing employee expenses. But what if that same process could actually be a source of strategic advantage, not just a back-office burden?

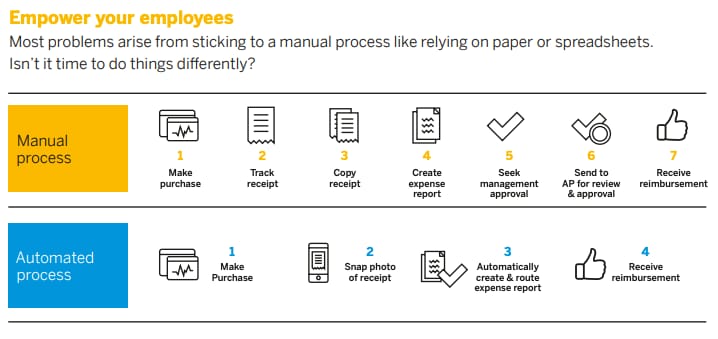

In today’s business environment where agility, visibility, and control are non-negotiables, a clunky expense process can quietly sabotage your bottom line. The manual work, the missed insights, the time lost chasing receipts… it all adds up.

That’s why finance leaders across Australia and New Zealand are starting to ask a critical question:

“What does a best-practice expense process actually look like and how do we get there?”

The Expense Process Has Changed. Has Yours?

Whether you’re running lean in a growing SMB, juggling compliance in a mid-market operation, or managing complexity across a large enterprise, the fundamentals are the same:

-

Employees need simple, intuitive tools

-

Finance needs visibility, accuracy, and control

-

The business needs policy compliance without creating friction

But if your current process still relies on spreadsheets, manual approvals, or disconnected systems, you’re likely leaving money and insights on the table.

What Best-Practice Expense Management Looks Like

According to SAP Concur’s expert insights, best-practice expense management comes down to a few key building blocks:

- Automation at Every Step: From receipt capture to reimbursement, automation doesn’t just save time it reduces human error and enforces policy without micromanagement.

- Integrated Systems: When your expense, travel, invoice, and ERP systems talk to each other, finance teams get real-time visibility and better data for decision-making.

- Policy Built-In, Not Bolted On: A best-practice process doesn’t rely on employees remembering the rules. Instead, policies are embedded right into the tools they use, reducing out-of-policy spend automatically.

- Mobile-First, User-Friendly Tools: If submitting an expense takes more than a few taps, people will delay it or skip it. Best-in-class solutions meet employees where they are: on their phones, on the go.

Here is a quick walk through the six critical stages where even minor tweaks can deliver major wins, with plus plenty of dot-point actions you can adopt this quarter:

1. Submitting Claims - Empower Employees

-

Mobile first: let staff snap receipts the moment they pay; no paper, no panic later.

-

Pre-populated reports: pull card feeds and e-trip itineraries directly into claims.

-

Real-time policy tips: on-screen alerts stop out-of-bounds spend before it starts.

-

One-minute rule: aim for claims that take 60 seconds or less to prepare.

2. Manager Approvals - Keep Work Moving

-

Push notifications nudge approvers wherever they are—mobile, web or email.

-

Auto-delegation covers annual leave so claims never stall.

-

Inline policy guidance helps managers decide fast without memorising every rule.

-

Publish a monthly “speed-to-approve” leaderboard to encourage good habits.

3. Data Processing - Remove the Re-Keying Grind

-

Import card, travel and e-invoice data automatically; zero manual typing.

-

Surface pending claims early so finance accrues accurately.

-

Standardise GL coding across all cost centres to simplify reconciliations.

-

Target a < 5-minute finance touch per expense report.

4. Auditing & Compliance - Trust the Numbers

-

AI flags duplicate receipts, round-number mileage and missing GST lines.

-

Route only exceptions to humans; 100 % of claims are still checked, but effort plummets.

-

Outsource periodic audits to specialists if internal bandwidth is tight.

-

Track first-pass compliance and set a 10 % quarterly improvement goal.

5. Reimbursement - Pay People Promptly

-

Integrated payments cut reimbursement time from nine days to four on average.

-

Auto-validation kicks back incorrect bank details to employees—no finance intervention.

-

Offer same-day corporate-card settlement to keep card limits free for the next trip.

-

Communicate a consistent payment calendar so staff can plan cash-flow confidently.

6. Insight & Reporting - Turn Data into Dollars

-

Live dashboards display spends by project, vendor or region in seconds.

-

Use analytics to renegotiate rates with top suppliers and airlines.

-

Identify serial non-compliance and target micro-training where it matters.

-

Feed expense trends into rolling forecasts for always-current cash-flow visibility.

Why This Matters Now More Than Ever

With economic uncertainty, remote work, and rising employee expectations, businesses can’t afford wasteful, outdated processes. Finance leaders are under pressure to do more with less, ensure compliance, and deliver insights not just reports.

Yet many businesses still rely on manual, reactive or piecemeal approaches to expense management.

The good news? You don’t need to overhaul everything at once.

Get the Blueprint to a Best-Practice Expense Process

Whether you’re starting from scratch or looking to refine what you’ve got, SAP Concur’s Blueprint of a Best-Practice Expense Process offers a clear, practical roadmap for finance leaders. Inside, you’ll discover:

-

The 5 key phases of the expense lifecycle

-

Common pitfalls to avoid at each stage

-

How to reduce fraud, improve compliance, and gain real-time visibility

-

Actionable tips to modernise your process—regardless of your company size

Download the guide now to future-proof your expense process and empower smarter decisions.

Because when your expense system works for your business, not against it, you unlock time, trust, and transformation.

Bonus: Want help benchmarking your current process?

Ask us how to assess where you are today and what quick wins could create real impact for your finance team.